Ethical AI for Lending

SPECIALTY

Explainable AI, Strategy and Policy, Human Centered Design, UI

INDUSTRY

AI, Lending and Finance

TIMELINE

Fall 2025

ROLE

HCI Research, UX Design, UI

INTRODUCTION

As artificial intelligence increasingly shapes who is deemed creditworthy, financial decision-making has become faster but also more opaque due in part to “black box” machine learning models that are difficult to explain. Millions of borrowers now receive instant, algorithmic approvals or denials with little understanding of why. This project examines how human-centered design and ethical AI principles can enhance the transparency, fairness, and empowerment of automated lending systems. Grounded in the frameworks of Data Feminism (D'Ignazio and Klein, 2020) and Design Justice (Costanza-Chock, 2020), this research investigates how explainability, participatory design, and examining power can be woven into digital lending dashboards, transforming the “black box” of credit decisions into a space for user understanding, agency, and ambition.

BACKGROUND & PROBLEM SPACE

AI-driven lending is rapidly expanding, transforming how financial institutions assess risk and make credit decisions. The global market for AI in financial services was valued at $38.36 billion in 2024, and is projected to reach $190.33 billion by 2030, reflecting a compound annual growth rate (CAGR) of about 30.6% (1). In 2025, roughly 78% of global banking organizations reported using AI in at least one business function (2). This rapid adoption is not inherently negative, as machine learning tools have already proven valuable in areas such as fraud detection, document intake, and customer service. However, as lenders increasingly rely on AI models to determine borrower eligibility and loan terms, a critical question arises: how can we ensure that borrowers maintain agency and that power does not shift entirely to favor the lender? This project will seek to answer that question by addressing three problems with AI-driven lending:

LACK OF TRANSPARENCY

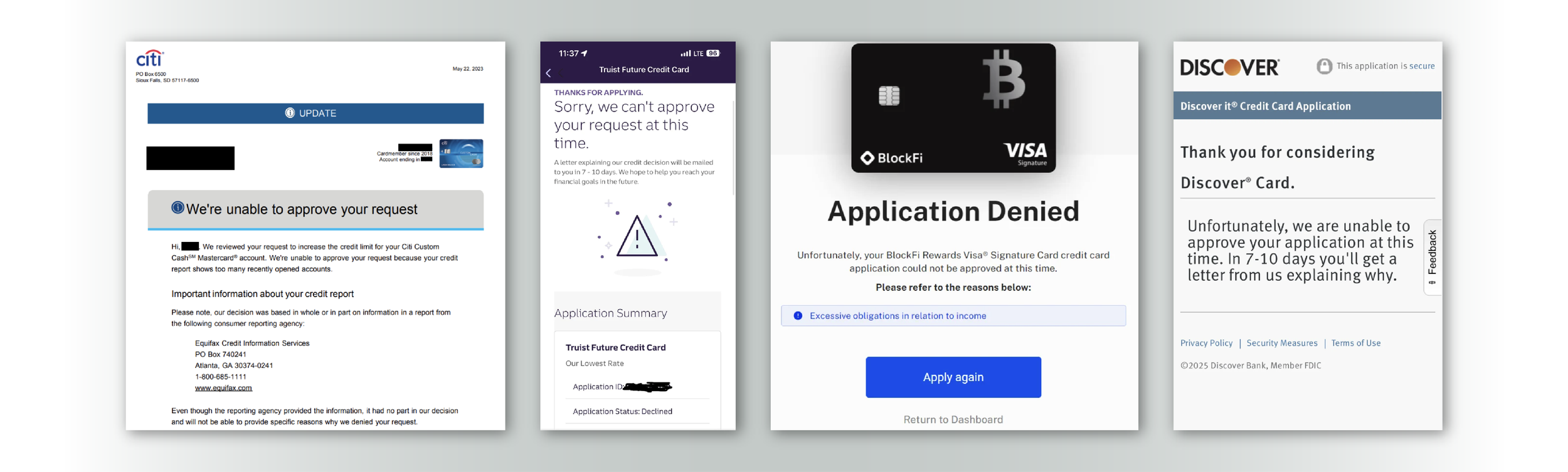

Existing systems tend to provide minimal explanations limited to vague or technical “adverse action” notices that fail to clarify how data points, algorithms, or model weights influence the outcome. This “black box” effect erodes user trust and prevents applicants from learning or improving.

AMPLIFICATION OF INEQUALITY

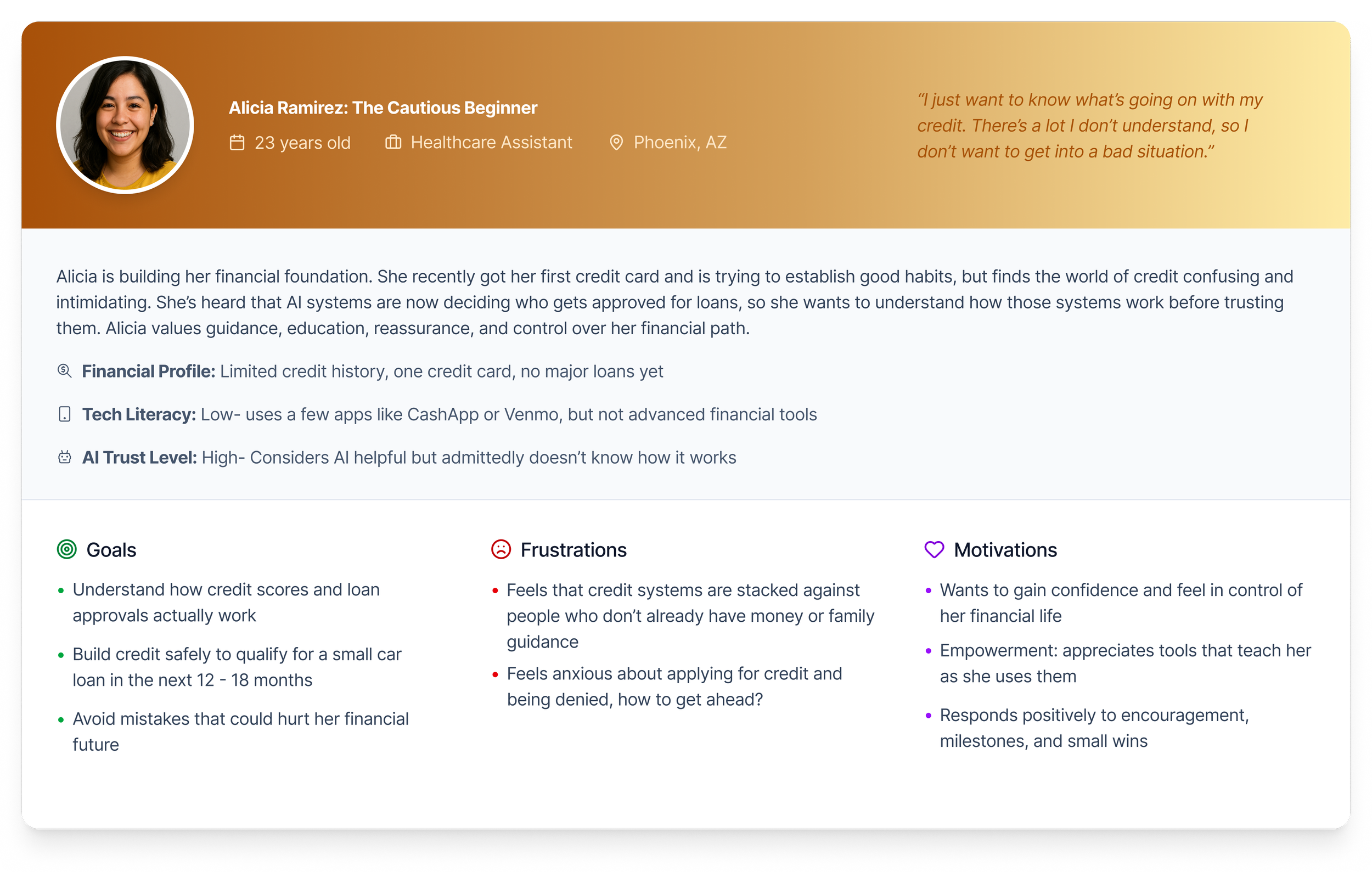

ML models in lending rely on historical data that may encode systemic bias. Even when protected attributes like race or gender are excluded, proxy variables (like ZIP code, education, and spending patterns) can still replicate inequity, leading to certain applicants, especially those from marginalized or nontraditional backgrounds, being excluded or misjudged by algorithms.

LIMITED BORROWER AGENCY

In most AI lending/ finance interfaces, users have no way to contest, clarify, or learn from a decision. Once the algorithm outputs “approved” or “denied,” the process ends, removing the opportunity for human review, personalized feedback, or educational guidance for next steps.

This perpetuates cycles of financial exclusion as denied applicants don’t know what to fix or how to qualify in the future.

This project examines how we can enhance transparency, education, and user confidence in AI-driven lending by designing systems that foster participation and understanding, rather than passive acceptance. We will explore how we can demystify the black box of machine learning, giving borrowers insight into how decisions are made and concrete steps to improve their financial standing. Beyond initial approval, the project envisions AI not as a gatekeeper, but as a companion tool that helps borrowers maintain healthy financial habits, build credit, and achieve long-term goals.

The aim is not to “outsmart” AI systems or secure approvals for unqualified applicants, but to align human and algorithmic decision-making toward mutual benefit: empowering borrowers to make informed improvements while protecting lenders through transparency, trust, and financial literacy.

AI in Finance Market Size, Share, Industry, Overview, Growth, Latest Trends. Retrieved from https://www.marketsandmarkets.com/Market-Reports/ai-in-finance-market-90552286.html

Superagency in the workplace: Empowering people to unlock AI’s full potential. Retrieved from https://www.mckinsey.com/capabilities/tech-and-ai/our-insights/superagency-in-the-workplace-empowering-people-to-unlock-ais-full-potential-at-work

RESEARCH PROCESS

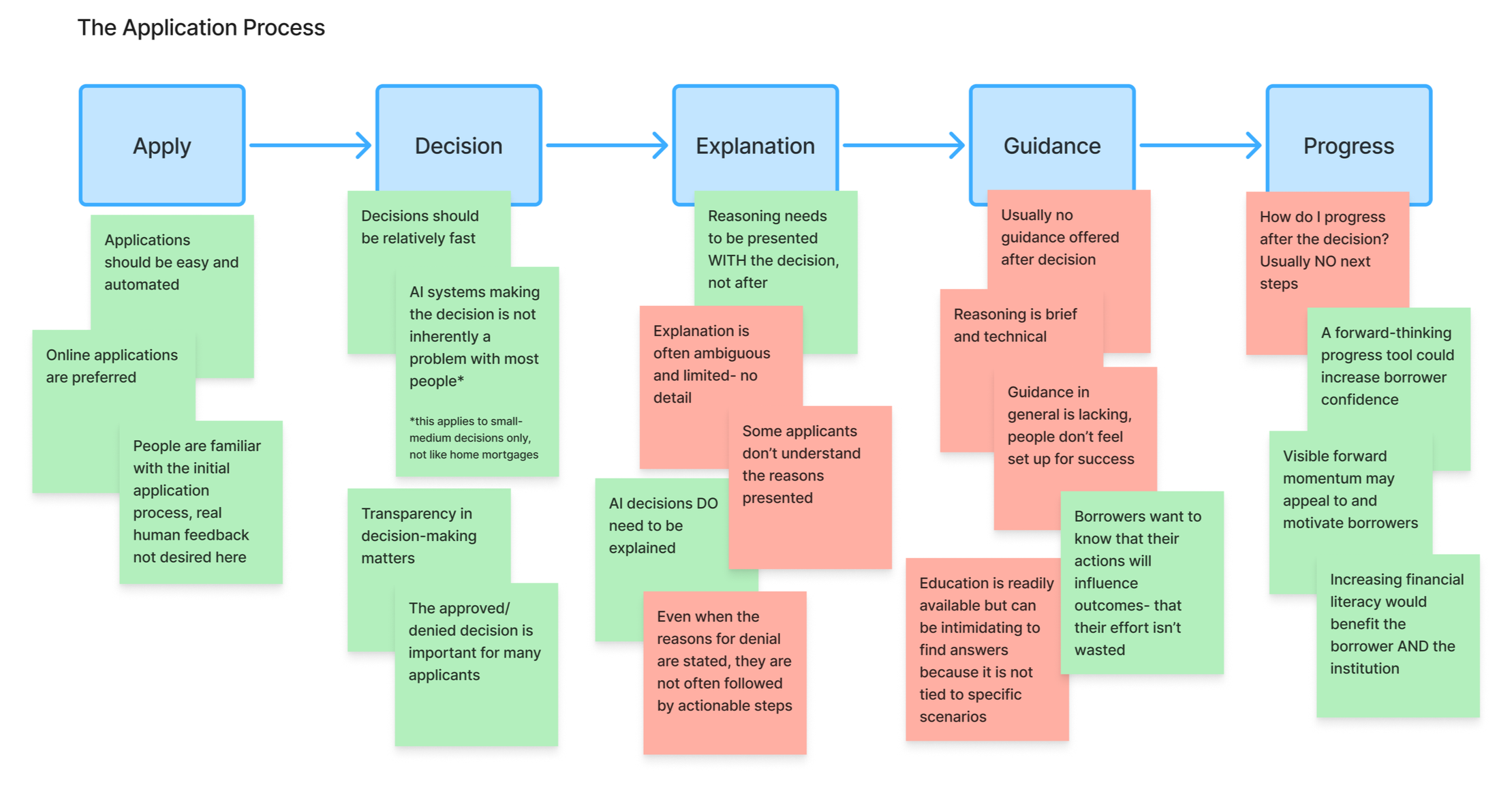

To better understand borrower experiences and perceptions of AI-driven lending, I conducted a mixed-methods study that combined user research with industry analysis. The user research included an online survey and a series of one-on-one interviews with loan applicants and users of digital finance products. The survey explored borrowers’ trust in AI systems, their confidence in understanding loan and credit decisions, and their expectations for fairness and recourse. The user research was complemented by a comparative analysis of seven leading financial platforms to examine how these tools communicate creditworthiness, deliver educational support, and present decision transparency to users.

USER RESEARCH

To capture a broad understanding of borrower perceptions toward AI-driven lending, I created a survey to gather quantitative and qualitative data on how users perceive fairness, trust, and transparency in automated credit decisions. I partnered with FL4A, the financial literacy extension of Operation HOPE, to distribute the survey to participants who had recently applied for a loan, credit card, were interested in financial literacy, and/ or were taking steps to proactively improve their financial situation.

To further explore the emotional and experiential aspects behind the survey responses, I conducted a series of detailed interviews with borrowers and users of digital finance products. These conversations revealed how applicants interpret AI-driven lending decisions, what factors build or erode their trust, and how design can better support transparency, user agency, and long-term financial success after approval.

76%

of participants do trust AI use in financial tools.

said they would trust AI more to make lending decisions if they knew what the decisions were based on

90%

said the largest barrier to improving their financial situation is that finances seem confusing and intimidating.

78%

86%

said they would use a digital AI tool for their personal finance if they could see progress

This diagram illustrates the key pain points, priorities, and user suggestions for lending application decisions that emerged during interviews, organized as a journey map to highlight moments of need and opportunity.

USER PERSONAS

INDUSTRY RESEARCH

I conducted a competitive analysis across leading AI-integrated financial platforms to identify how these products communicate creditworthiness, support financial literacy, and handle transparency around loan decisions. While each platform serves its users effectively within its focus area, several unmet user needs and design opportunities emerged (key takeaways summarized below the table).

WEAK CAUSALITY

Many products show credit scores, but rarely tie them to how a change would affect a specific loan decision. The weak connection between cause and effect limits user understanding by reinforcing the “black box” perception of AI decision-making, and does not contribute to continuous improvement or self-advocacy.

POWER FAVORS THE LENDER

Decision interfaces are designed primarily for efficiency and compliance, not for user agency. Borrowers are positioned as passive recipients of algorithmic outcomes, with limited visibility into how decisions are made or opportunities to contest them.

MISSING ACTIONABLE NEXT STEPS

Few tools translate AI insights into concrete, personalized actions. Borrowers are often given some high-level factors that contribute to their score, but not how to raise it or what behaviors would have the greatest impact. Because of this, feedback feels more like information overload rather than empowerment. Also, continued support for staying on track once approval is granted is severely lacking.

HUMAN-IN-THE-LOOP SUPPORT

Although many products automate decision-making effectively, few provide options for human review or personalized guidance. This absence of empathetic, human involvement can leave borrowers feeling alienated and powerless, especially after denials.

DESIGN OBJECTIVES & ETHICAL PRINCIPLES

The research phase uncovered key user behaviors, pain points, and opportunities, which were synthesized into a focused set of findings. These insights were then translated into actionable design objectives, each grounded in ethical principles that guided concept development. Drawing from frameworks such as Data Feminism (D’Ignazio & Klein, 2020), Design Justice (Costanza-Chock, 2020), and Human-Centered AI principles, these goals establish a foundation for iterative design and usability testing in the next phase, ensuring that the design decisions support transparency, empowerment, and mutual benefit for both borrowers and lenders.

DESIGN OBJECTIVE

Make AI Lending Decisions Transparent and Understandable

The design aims to clarify how data inputs influence outcomes through explainable visuals and plain-language reasoning. While borrowers may not be able to directly change a lender’s decision, increasing transparency helps them understand the logic behind it and identify concrete ways to improve for future applications.

Provide Actionable Guidance to Support Continuous Improvement

Many users wanted to know not just why they were denied, but how to improve. This goal focuses on turning AI explanations into actionable next steps with progress-tracking tools, supporting financial literacy and growth over time.

Reintroduce Human Support and Recourse

Participants emphasized the importance of having access to a human reviewer or counselor after an AI decision. This design goal ensures a human remains “in the loop,” offering more personal explanations if desired, and the option to contest decisions.

Design for Long-Term Financial Empowerment

Rather than treating loan approval as an endpoint, this goal positions AI as a financial coach that helps borrowers sustain good habits, build credit, and reach future milestones. The goal of borrower success also favors the lender by protecting their investment, reducing default risk, and increasing the user’s future borrowing potential.

ETHICAL PRINCIPLE

Examine Power from Data Feminism

By examining where power lies in decision-making, this goal promotes informed participation rather than passive acceptance, transforming opacity into clarity and trust.

Empowerment Through Education, aligned with Design Justice

Designing with education embedded ensures that AI doesn’t gatekeep access to opportunity but instead becomes a partner in building user confidence, agency, and ability.

Nothing About Us Without Us from Design Justice

By allowing the option for human connection, the system honors procedural fairness and ensures borrowers retain agency in the decision process.

Redistribute Power from Design Justice

By designing for long-term empowerment, the system redistributes power from lenders to borrowers, transforming AI from a gatekeeper into a supportive companion. Additionally, the reciprocal relationship reframes lending as a partnership, supporting both financial stability for the user and institutional trust.

IDEATION & CO-DESIGN

Building on the design objectives and ethical principles, the next phase focused on transforming insights into tangible ideas through collaborative ideation. To ensure the design concepts aligned with borrower needs, I conducted a co-design session with stakeholders using low-fidelity paper prototypes. This participatory approach invited users to directly shape early design directions by sketching, annotating, and assembling some pre-made features based on what they found most meaningful.

WIREFRAMES & PROTOTYPES

Building on the insights from the co-design phase, I translated key research findings and participant feedback into a set of mid-fidelity prototypes focusing on core features and interactions that support the design objectives.

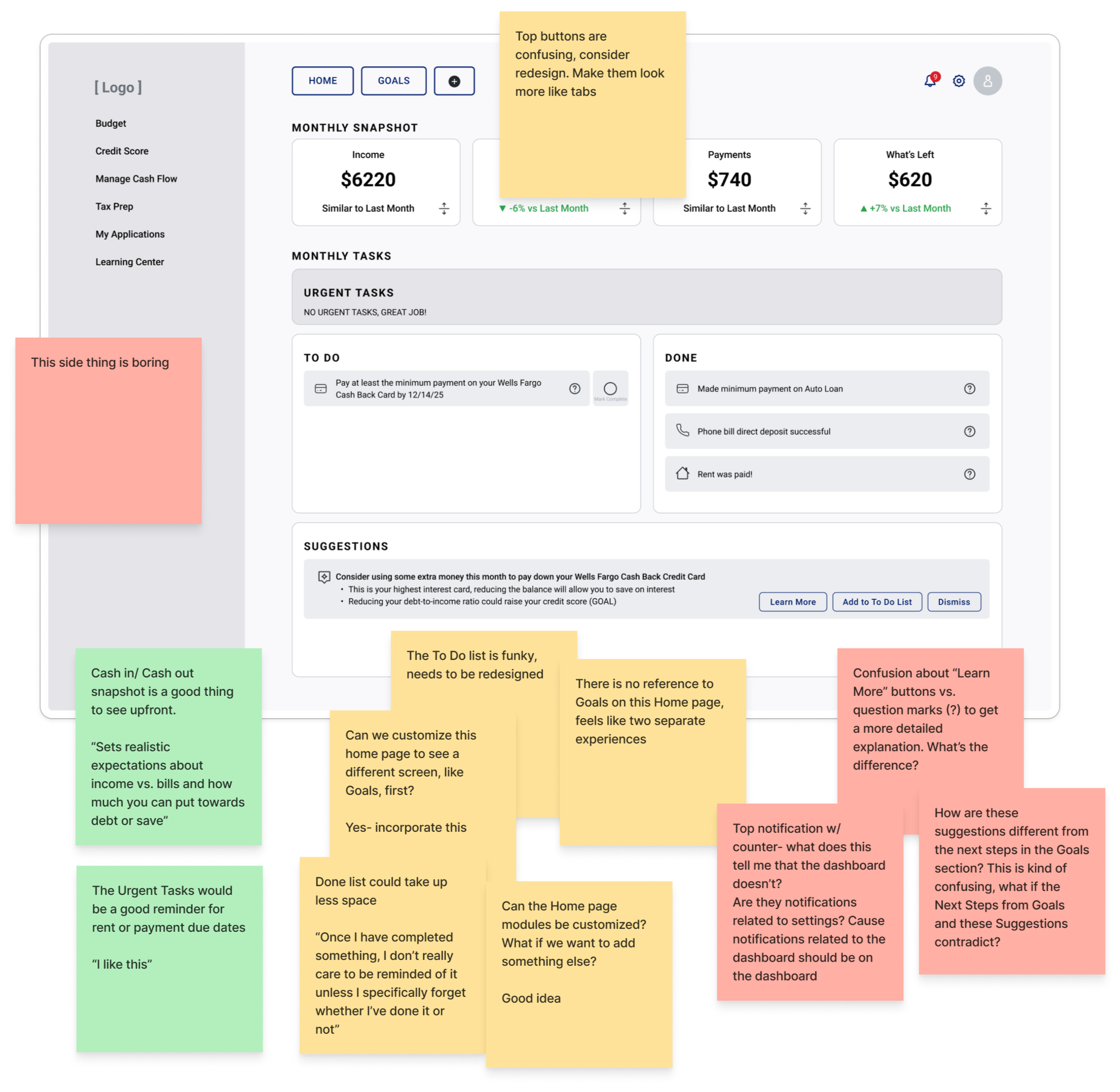

DASHBOARD HOME: PERSONALIZED FINANCIAL SNAPSHOT

The Dashboard Home serves as a customizable snapshot of the user’s monthly finances, offering a clear view of where they stand today and highlighting the most pressing actions to prioritize. This screen helps users quickly assess their current financial health before exploring deeper features like goal tracking, credit insights, or loan applications.

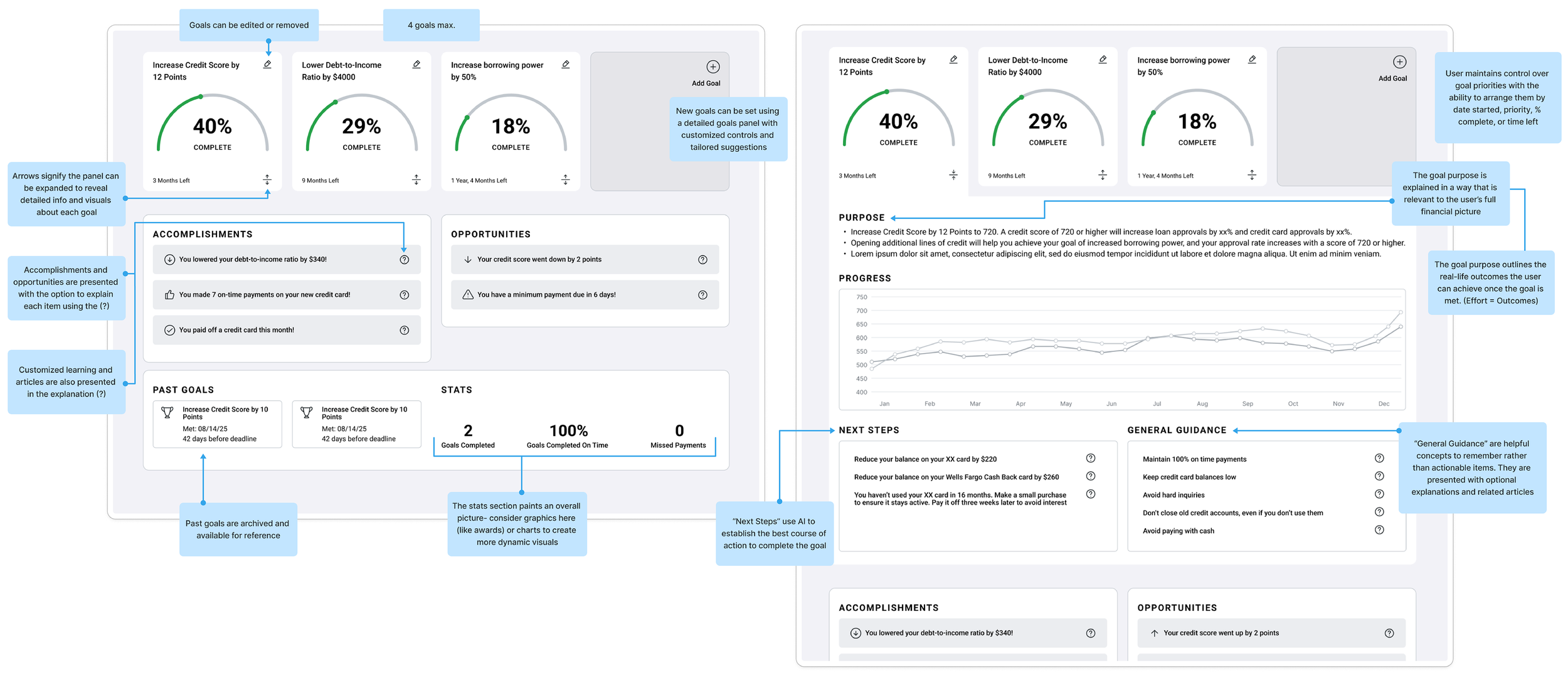

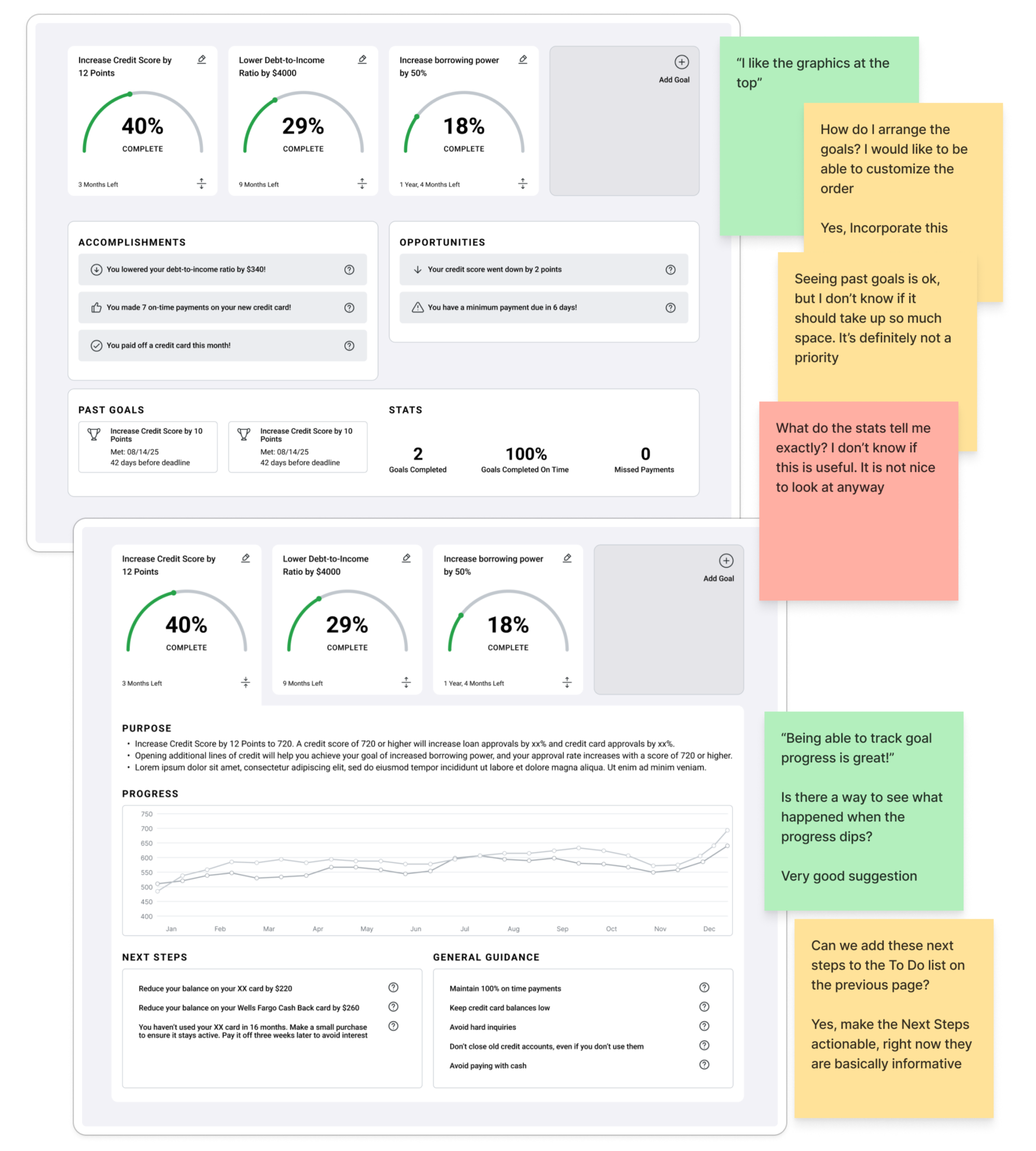

THE GOALS SECTION: BUILDING LONG-TERM FINANCIAL SUCCESS

The Goals section helps users set, track, and visualize personal financial milestones such as improving their credit score, paying down debt, seeking a loan approval, or saving for a large purchase. Each goal connects directly to insights from the user’s AI lending data, showing how specific behaviors, like reducing credit utilization or making consistent payments, can improve future loan eligibility. This feature reframes financial management as an ongoing partnership between the borrower and the system, promoting motivation, accountability, and informed progress over time.

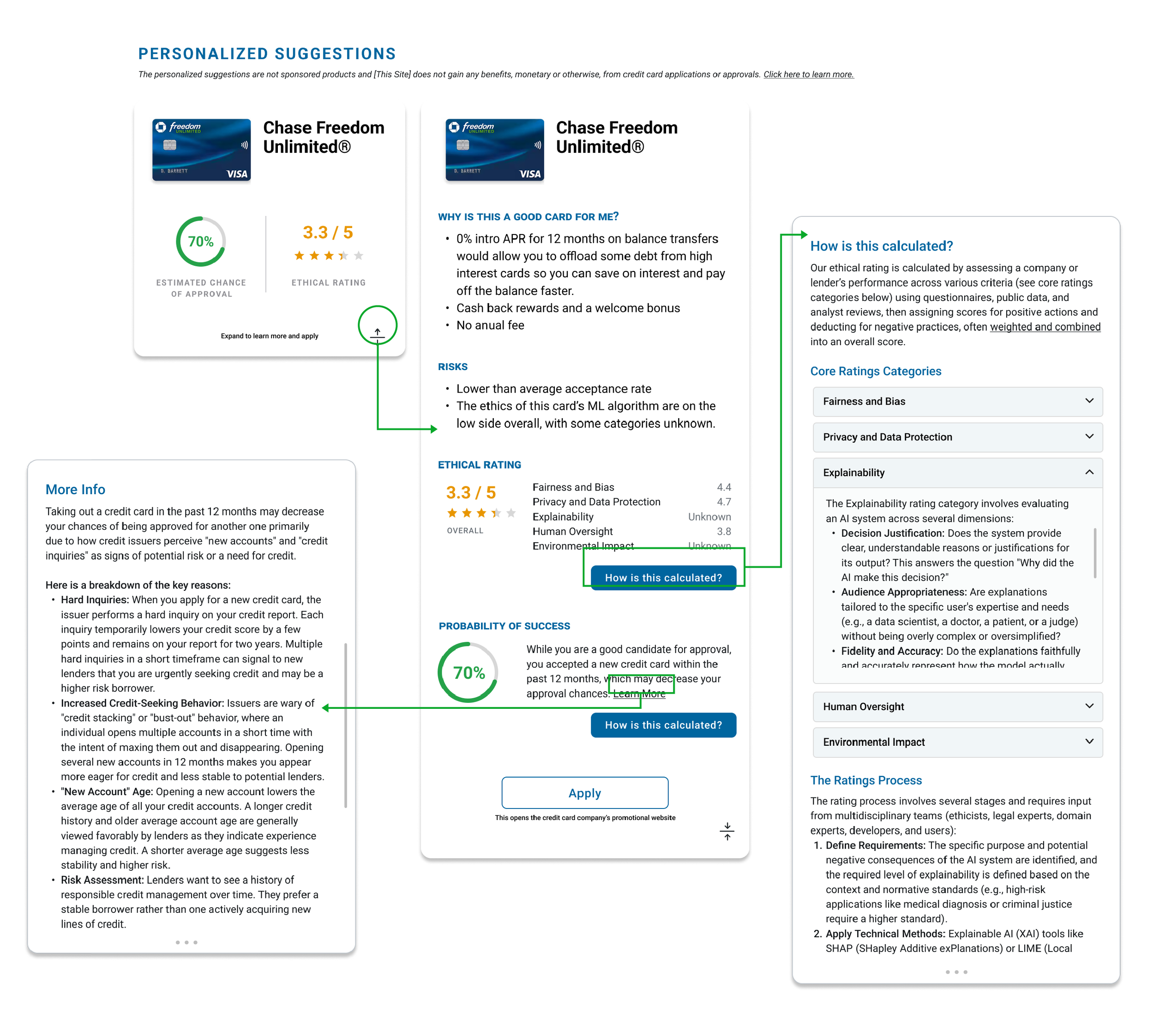

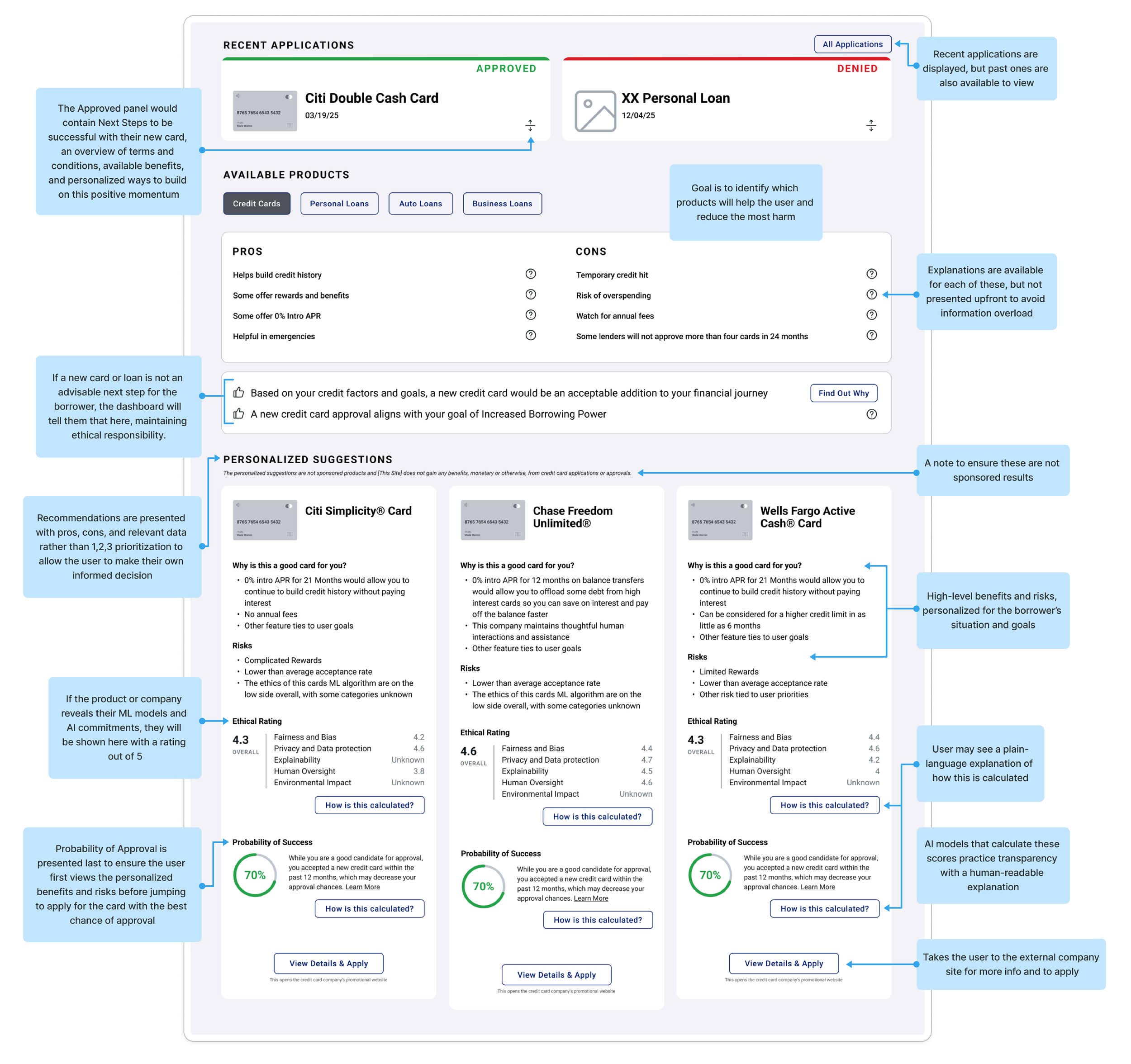

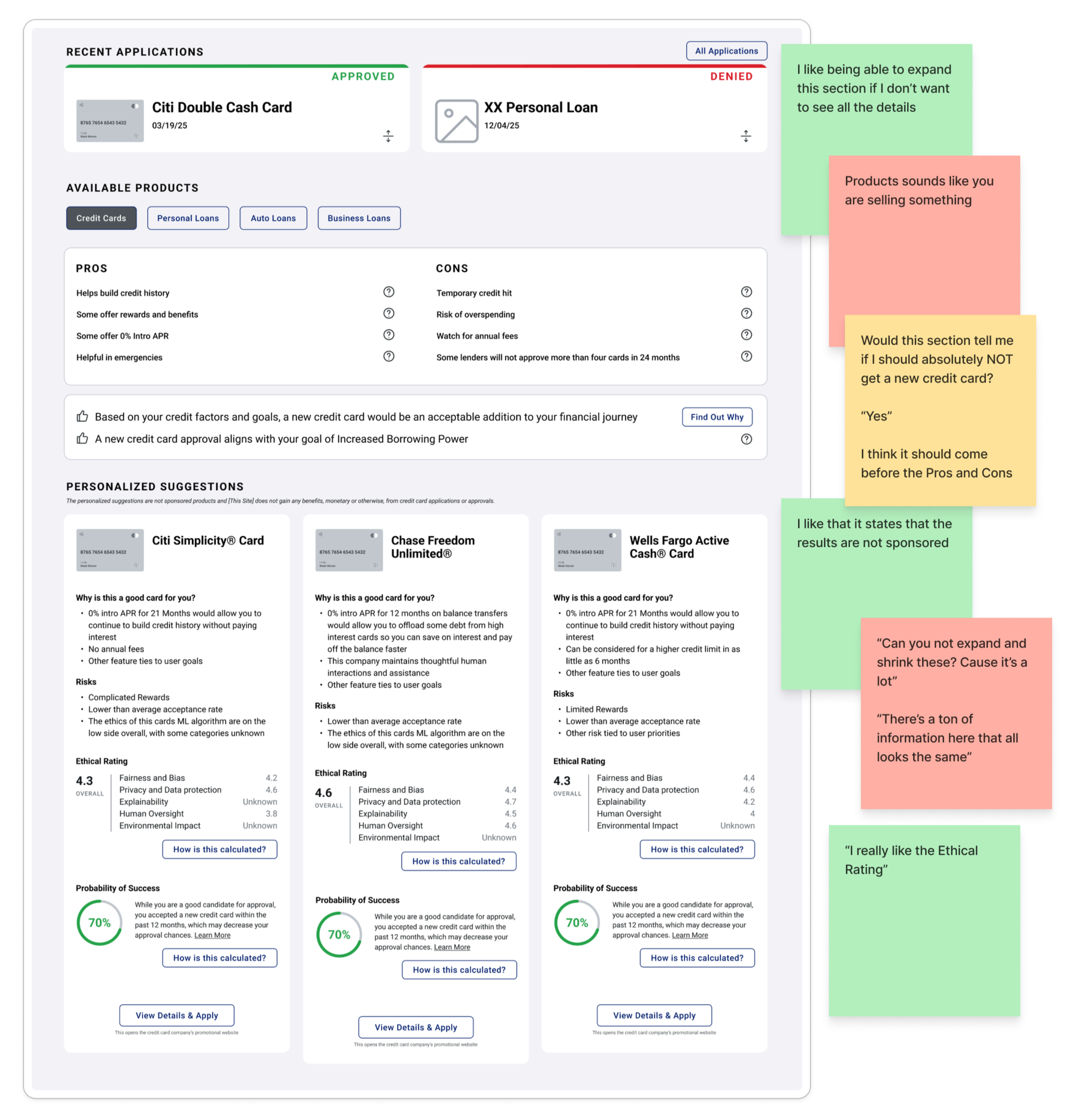

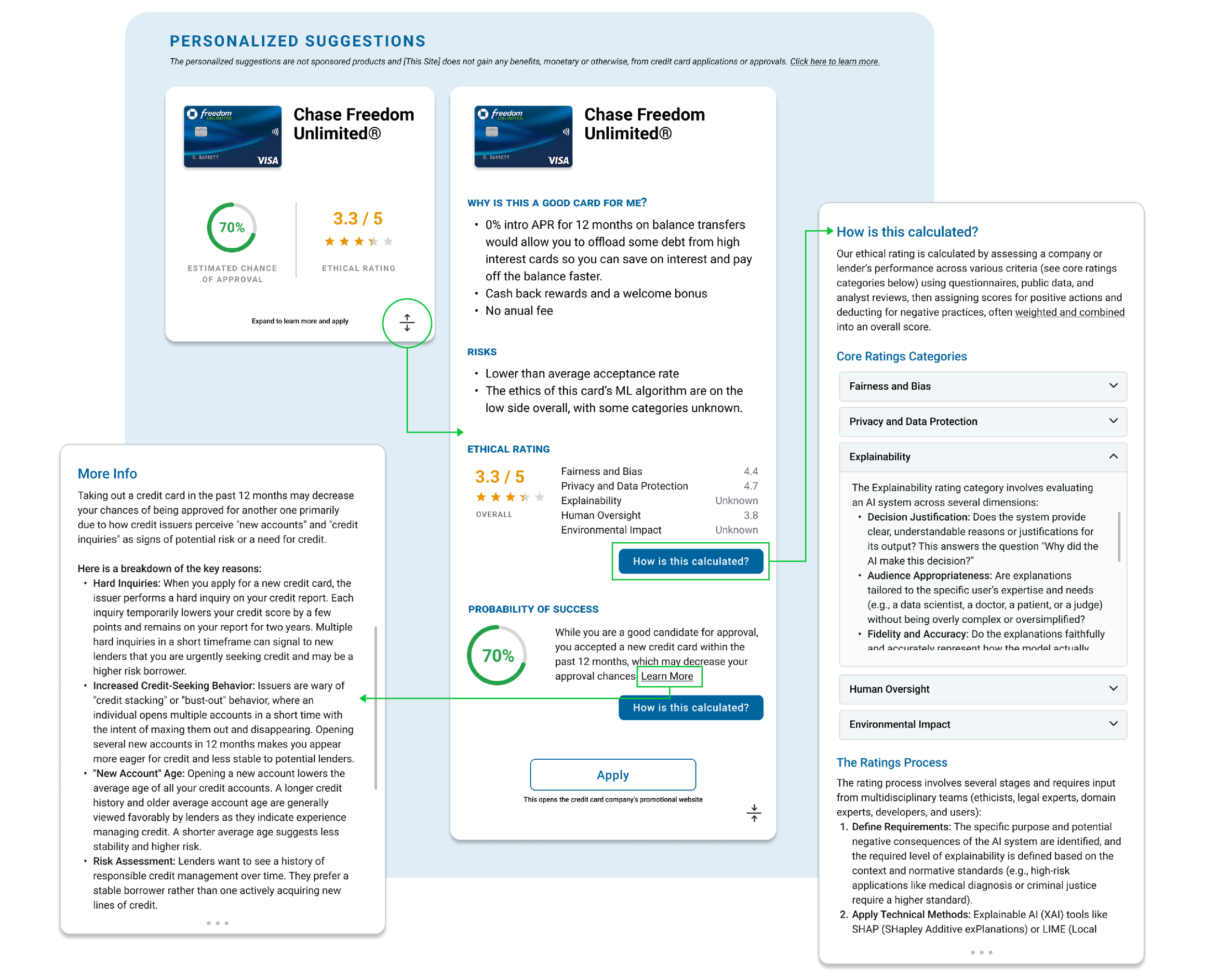

APPLICATIONS: PERSONALIZED OPTIONS WITH CONTEXT AND CLARITY

The Applications screen provides users with a view of their recent loan and/or credit card applications, as well as new products for which they may qualify. Each option includes transparent pros and cons, as well as a recommended course of action with additional details. Personalized credit card recommendations are generated using the user’s financial profile and established goals, allowing users to make informed choices. By presenting opportunities with clear context and reasoning, this feature strengthens user agency and fosters trust in both the AI system and the lending process.

USABILITY TESTING

Once key features were designed, I conducted usability testing sessions to assess how borrowers interacted with the new explainable dashboard. The goal was to observe whether design decisions grounded in the ethical principles of transparency, education, and empowerment actually translated into a more understandable, human-centered lending experience that reinforces user agency and supports financial growth.

KEY FINDINGS

Snapshot is Understandable, Needs Revision for Clarity

Most participants quickly grasped that the home screen provides a personalized overview of their monthly finances and found it helpful. Hierarchy of features is successful. Design revisions to individual sections is needed to increase clarity and usability.

Actionable Items Increase Motivation

Participants appreciated that the dashboard felt actionable rather than purely informational, encouraging them to take suggested steps toward improvement.

Users Want More Customization

Additional customization of the Home page (add tabs to the top bar, add feature blocks to the body) would increase users’ sense of ownership and agency.

Tone and Visual Language Could Be More Supportive

Though the hierarchy is successful, users did not have strong positive feelings about the straightforward tone and visuals. Design final dashboard in a friendly tone to reinforce trust and reduce anxiety.

Progress Visualization Strengthened Understanding

Most reported that visual cues helped users feel motivated and capable of improvement over time.

Alignment Between Goals and Outcomes Increased Engagement

Users appreciated goals that were explicitly tied to measurable financial outcomes, such as “Reduce credit utilization by 10% to achieve +12 points potential credit increase.” This made goals feel purposeful and achievable.

Users Wanted More Guidance on Setting Realistic Goals

Several participants expressed uncertainty about how to choose achievable financial goals using the “Add Goal” functionality. This screen was not created as part of this iteration, but this feedback is very important for future wireframes.

Desire for Deeper Integration Across Features

Some users observed that the goals should connect more dynamically with other parts of the dashboard, such as the Home page. Will introduce connections between the informative Next Steps and the To Do tasks on the Home page.

Pros and Cons Lists Supported Confident Decision-Making

Side-by-side pros and cons helped users feel empowered to evaluate products on their own terms rather than relying on marketing claims. This feature was described as “honest,” “balanced,” and “educational.”

More Guidance Desired for the “Should I Apply?” Feature

The honest “Should I Apply?” recommendations provided personalized clarity that users found both practical and confidence-building. Users would like to see more priority given to this section.

Non-Sponsored Product Listings Strengthened Credibility

Users noticed and appreciated the absence of advertisements or sponsored rankings. This transparency and ethical positioning boosted perceptions of fairness and integrity.

Information Density Needs Revision

All users felt that the page presented a lot of information at once. They suggested visual hierarchy improvements (like better content grouping or progressive disclosure) to prevent information overload.

NEXT ITERATION PLAN

IMPROVE HIERARCHY AND COMPREHENSION

Why: Testing showed that users appreciated transparency but sometimes felt overwhelmed by information density on key pages.

How:

Expand areas of progressive disclosure, allowing users to view detailed explanations only when desired.

Add strategy to contextual “info” tooltips/ pop-ups to explain credit factors and decision terms without visual clutter.

Conduct a quick A/B test comparing current vs. simplified hierarchy to measure comprehension speed and retention.

Success Metric: At least 90% of users report comfort with the amount of information on post-test surveys.

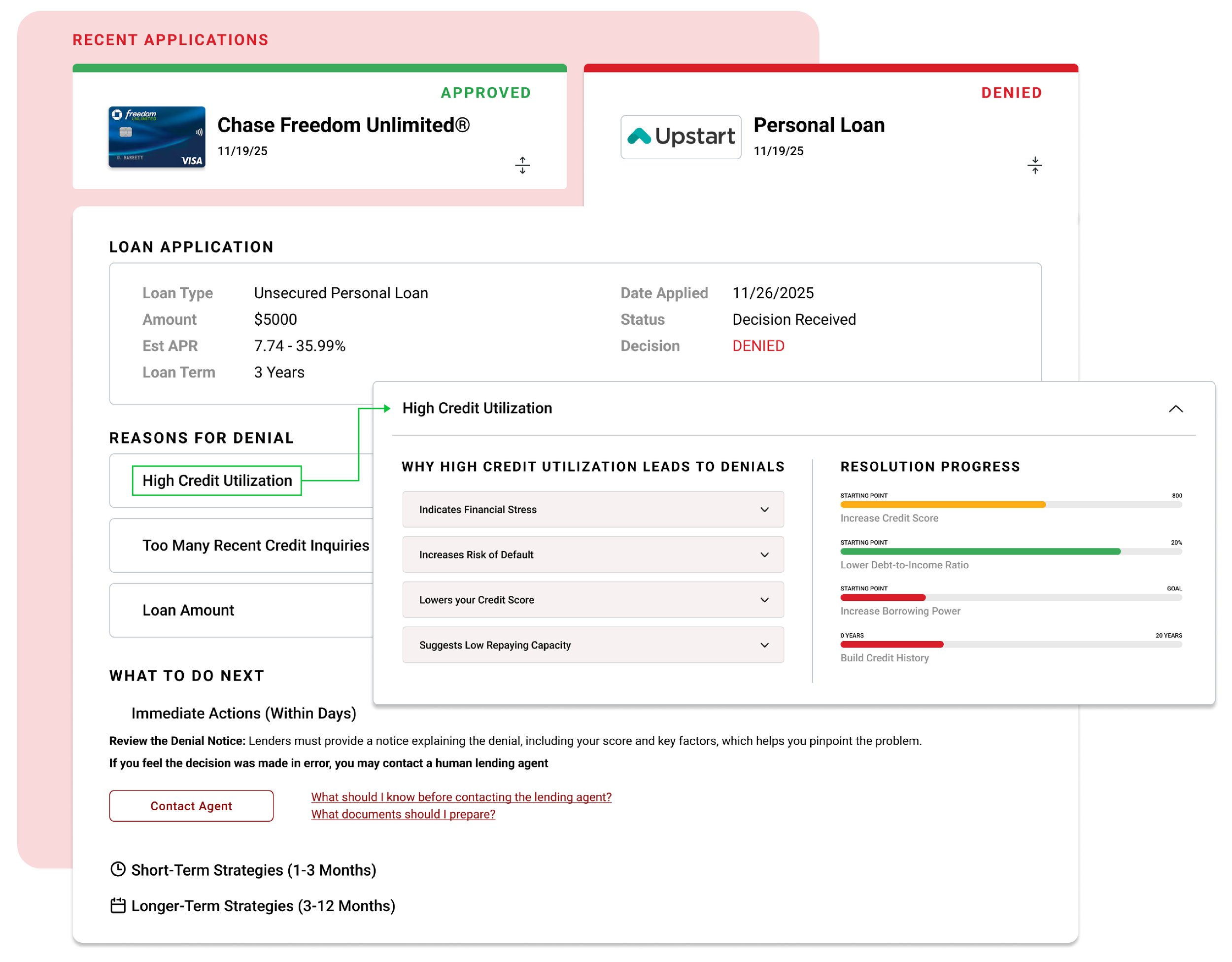

DEEPEN EMOTIONAL AND ETHICAL DESIGN OF DENIAL EXPERIENCE

Why: Users appreciated the constructive tone of denial explanations but wanted clearer next steps and a visual sense of improvement potential.

How:

Add a mini progress tracker showing how current efforts are improving credit readiness.

Integrate educational links for each denial reason.

Iterate on tone, add more empathetic, coaching-style phrasing.

Success Metric: Post-denial satisfaction (via short in-session survey) increases from baseline average. At least 70% of users report feeling “motivated to try again” rather than discouraged.

COLLABORATE WITH FINANCIAL INSTITUTIONS TO EXPLORE WHERE ADDITIONAL HUMAN-IN-THE-LOOP EXPERIENCES COULD BE ADDED

Why: The “Contact Agent” button was reassuring, but users wanted to know what happens next, however feasibility and real-world alignment with lending compliance and AI regulation will need to be validated.

How:

Conduct stakeholder interviews with loan officers or fintech compliance teams.

Map and prototype the handoff flow between user and support agent (or decision maker).

Develop a technical feasibility concept for integrating explainability models into the dashboard layer.

Success Metric: Confirmation that features can comply with legal “adverse action notice” standards. Users report reduced anxiety levels (self-reported comfort rating increase by at least 25%)